Alexander Hamilton, who was first secretary of U.S. Treasury assumed all the debts incurred by Revolutionary War. He then resold the debt, promising a good return to U.S. speculators. The proceeds of these sales were used to finance his new government. Hamilton eventually became the nation's first Treasury secretary.

Asset maturities

A key aspect of financial planning is asset maturity management. The maturity dates of assets and liabilities determine whether they will create cash outflows or inflows. You can calculate the effective maturity using the 'liquidity length', which is the estimated time an entity will need for an instrument to be disposed of in a crisis. It is also possible predict non-maturity assets by using historical data on client behavior.

Asset management is a coordinated and systematic process required to meet an organisation's objectives. It is a leading indicator of future performance and serves as a guide to improvement. You can compare the maturity of a company to its target maturity and identify areas for improvement.

Cash-flow mismatches

Cash-flow mismatches occur when assets and liabilities do not match. It can be caused, among other things, by interest rates or cash flows. Regardless of the reason, mismatched cash flows can create major problems for banks. There are a variety of ways to minimize this risk.

Traditional portfolio management can help minimize exposure to fluctuating and rising interest rates. These measures can also be used to reduce seasonal exposures. They can reduce seasonal exposures. However, members often feel the effects of these measures by changing their terms for borrowing and deposit. Alternative measures, such derivatives, are often more transparent.

Interest rate risk (IRR) exposures

Although the overall level of IRR exposure in banking seems to be moderate, some institutions may have higher levels. For example, more than half (50%) of the eurozone's banks would suffer from an increase in interest rate. While the overall level of banks' IRR exposure has declined since the start of the year, the volume of longer-dated receiver floating swaps has increased since March 2021. This suggests that banks in the euro area are using derivatives as hedging tools. You should monitor your bank's IRR exposures.

It is essential for banks to manage IRR by establishing robust interest rate exposure management processes. These include strong corporate governance, effective risk measuring systems and internal controls. It is also important to assess the impact of any new strategies on your company's IRR exposure.

Asset/liability comittee (ALCO).

An asset/liability committee is the group responsible for managing a bank's assets and liabilities. Its members monitor the bank’s balance sheets and can have a major impact on its stock price and net earnings. It also reviews the bank's interest rates risk, which is part of its operating model.

The Asset/Liability Management Committee meets on a regular basis to review the organization's financial health, evaluate its liquidity, funds management policies, approve contingency plans, and review its financial performance. It reviews the status and funding sources for short-term financing. It also reviews the company's interest on risk-management and interest rate risk.

Methods

Asset liability management involves managing financial assets and liabilities. It is a multifaceted discipline. There are many researchers who have devised the strategies for managing these investments. Many of them are experts in specific areas of asset and liabilities management. A portfolio that is balanced and profitable for the company is one example of an asset strategy.

Financial institutions are able to use sophisticated analytical tools for asset management to understand their risks and profitability better. They also assist in determining the optimal balance sheet composition and optimal asset allocation. This way, financial institutions can continue to improve their overall profitability and competitiveness.

FAQ

Why is it important for companies to use project management techniques?

To ensure projects run smoothly and meet deadlines, project management techniques are employed.

This is because many businesses depend heavily upon project work to produce products and services.

These projects must be managed efficiently and effectively by companies.

Companies could lose their time, reputation, and money without effective project management.

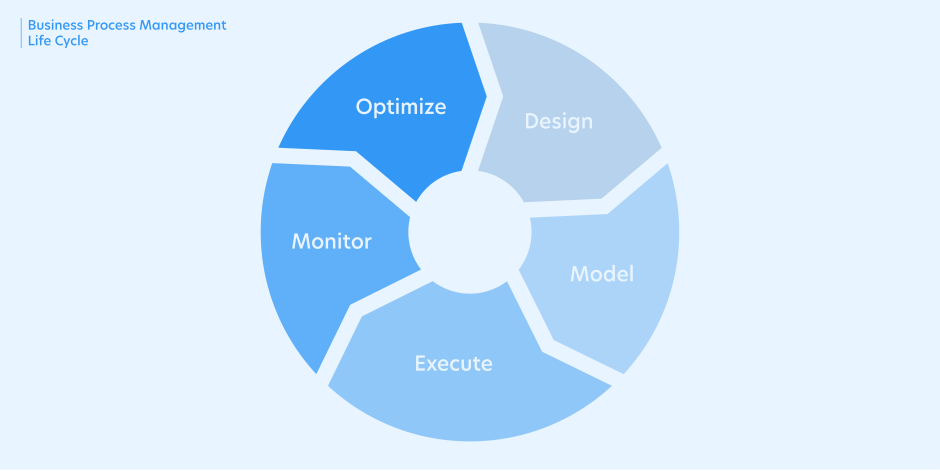

What are the five management process?

The five stages of any business are planning, execution, monitoring, review, and evaluation.

Planning is about setting goals for your future. It includes defining what you want to achieve and how you plan to do it.

Execution takes place when you actually implement the plans. They must be followed by all parties.

Monitoring is the act of monitoring your progress towards achieving your targets. Regular reviews should be done of your performance against targets or budgets.

Every year, there are reviews. They provide an opportunity to assess whether everything went well during the year. If not, changes may be made to improve the performance next time around.

After the annual review, evaluation takes place. It helps to determine what worked and what didn’t. It also provides feedback regarding how people performed.

How can a manager motivate employees?

Motivation is the desire to do well.

Doing something that is enjoyable can help you get motivated.

You can also be motivated by the idea of making a difference to the success and growth of your organization.

For example: If you want to be a doctor, you might find it more motivating seeing patients than reading medical books all day.

The inner motivation is another type.

You may feel strongly that you are responsible to help others.

Or you might enjoy working hard.

If you don't feel motivated, ask yourself why.

Then try to think about ways to change your situation to be more motivated.

What role can a manager fill in a company’s management?

There are many roles that a manager can play in different industries.

Managers generally oversee the day-today operations of a business.

He/she ensures that the company meets its financial obligations and produces goods or services that customers want.

He/she will ensure that employees follow all rules and regulations, and adhere to quality standards.

He/she designs new products or services and manages marketing campaigns.

What are the three basic management styles?

These are the three most common management styles: participative (authoritarian), laissez-faire (leavez-faire), and authoritarian. Each style has its own strengths and weaknesses. Which style do you prefer? Why?

Authoritarian - The leader sets the direction and expects everyone to comply with it. This style works best if the organization is large and stable.

Laissez-faire - The leader allows each individual to decide for him/herself. This approach works best in small, dynamic organizations.

Participative - Leaders listen to all ideas and suggestions. This style works best in smaller organizations where everyone feels valued.

What are the key management skills?

Business owners need to have management skills, no matter how small or large they may be. They include the ability to manage people, finances, resources, time, and space, as well as other factors.

You will need management skills to set goals and objectives, plan strategies, motivate employees, resolve problems, create policies and procedures, and manage change.

As you can see, there are many managerial responsibilities!

What are the most common errors made by managers?

Sometimes managers make it harder for their employees than is necessary.

They may not be able to delegate enough responsibility to staff or provide adequate support.

In addition, many managers lack the communication skills required to motivate and lead their teams.

Some managers create unrealistic expectations for their teams.

Managers may prefer to solve every problem for themselves than to delegate responsibility.

Statistics

- Hire the top business lawyers and save up to 60% on legal fees (upcounsel.com)

- The profession is expected to grow 7% by 2028, a bit faster than the national average. (wgu.edu)

- 100% of the courses are offered online, and no campus visits are required — a big time-saver for you. (online.uc.edu)

- The BLS says that financial services jobs like banking are expected to grow 4% by 2030, about as fast as the national average. (wgu.edu)

- Your choice in Step 5 may very likely be the same or similar to the alternative you placed at the top of your list at the end of Step 4. (umassd.edu)

External Links

How To

How can you apply the 5S in the office?

A well-organized workspace will make it easier to work efficiently. An organized workspace, clean desk and tidy room will make everyone more productive. The five S’s (Sort. Shine. Sweep. Separate. and Store) all work together to ensure that every inch is utilized efficiently and effectively. In this session, we'll go through these steps one at a time and see how they can be implemented in any type of environment.

-

Sort.Put away papers and clutter so that you don't waste valuable time searching for something that you know is there. This means you place items where you will use them the most. Keep it near the spot where you most often refer to it. You should also consider whether you really need to keep something around -- if it doesn't serve a useful function, get rid of it!

-

Shine. Don't leave anything that could damage or cause harm to others. For example, if you have a lot of pens lying around, find a way to store them safely. It might mean investing in a pen holder, which is a great investment because you won't lose pens anymore.

-

Sweep. Clean off surfaces regularly to prevent dirt from building up on your furniture and other items. To keep surfaces as clean as you can, invest in dusting equipment. You can also set aside an area to sweep and dust in order to keep your workstation clean.

-

Separate. Separate your trash into multiple bins to save time when you have to dispose of it. Trash cans are usually placed strategically throughout the office so that you can easily throw out the garbage without searching for it. It's a great idea to place trash bags beside each bin, so you don’t have to go through tons of garbage to find what it is.