The financial system's risks are not only for banks, but also for all other institutions. There are two types of risk: systemic risk and un-diversifiable. The first affects all economic markets, while un-diversifiable risk is restricted to one asset or sector. It can also be called market risk, particular or residual risk.

Reputational Risk

The field of reputational risks management has seen significant growth in recent years. As a result, several regulatory bodies have called for more detailed guidelines on how to manage reputational risk. These guidelines include a process of risk identification, analysis and treatment.

Banks can lose customers due to reputational risk. There are many reasons reputational risks can occur. For example, the quality of customer service, security, and the history of regulatory compliance can all hurt a bank's reputation. In addition, widespread economic challenges can damage a bank's reputation. Repairing the damage can cost a lot.

ESG risk

Banks need to assess the impact of ESG issues on credit risk profiles. The failure to properly address ESG issues can result in financial risk, poor reputation, misconduct risks, and pricing errors. This can have a negative impact on investor confidence, liquidity, business development, and investor trust. There are many options to reduce the impact these risks have on the bank's credit risk profile.

ESG risks are often associated with industries that use a lot of resources or are extractive. Although financial services isn't as well-known and understood as other industries like those mentioned above, the implications can still be significant and require board oversight.

Oversight of staff

Banks need to focus on risk management and must monitor their staff. They are the primary drivers of company performance. These employees can pose operational risks. Recent events such as LIBOR manipulation and foreign exchange manipulation have highlighted the human element in financial institutions. In the past, HR was responsible for addressing this risk, ensuring that the right people were hired and that conduct issues were appropriately investigated. Banks are now beginning to recognize that the human factor is a risk factor and are including it in their risk management.

Recognizing and assessing emerging risk is one of the greatest challenges in managing risks. These types of risk often fall under the operational risks umbrella and are difficult to monitor. These risks can only be managed by specialists. Management of fraud, for example, requires an in-depth knowledge of the fraud types and first-line processes. Understanding gameable systems, non-transparent communication are essential to monitor conduct risks. In the capital market, this means monitoring and addressing misselling, misconduct, and other mishaps by unscrupulous employees.

Natural disasters

Banks' financial performance can be affected by natural catastrophes. These events can impact deposits, create an increase in non-performing loans, or require the reorganization of loan portfolios. They can also result in bank panics or excessive losses. These events can also result in adverse selection or moral hazard when banks are unable to follow up on their loan strategies.

Through disaster risk financing strategies, banks are able to assist their customers in mitigating the negative effects of natural events. These strategies allow clients to determine the right balance between transferring risk and keeping it. Each client will find the best combination of approaches depending on the type of risk and the severity and frequency with which disasters occur. Because of its 70 years' experience in international markets as well as the execution of high-quality insurance transactions, it can assist clients in disaster risk financing strategies.

FAQ

How can a manager motivate employees?

Motivation refers to the desire or need to succeed.

Doing something that is enjoyable can help you get motivated.

You can also be motivated by the idea of making a difference to the success and growth of your organization.

For example, if your goal is to become a physician, you will probably find it more motivational to see patients rather than to read a lot of medicine books.

A different type of motivation comes directly from the inside.

You may feel strongly that you are responsible to help others.

Or you might enjoy working hard.

If you don’t feel motivated, find out why.

Then think about how you can make your life more motivating.

What does "project management" mean?

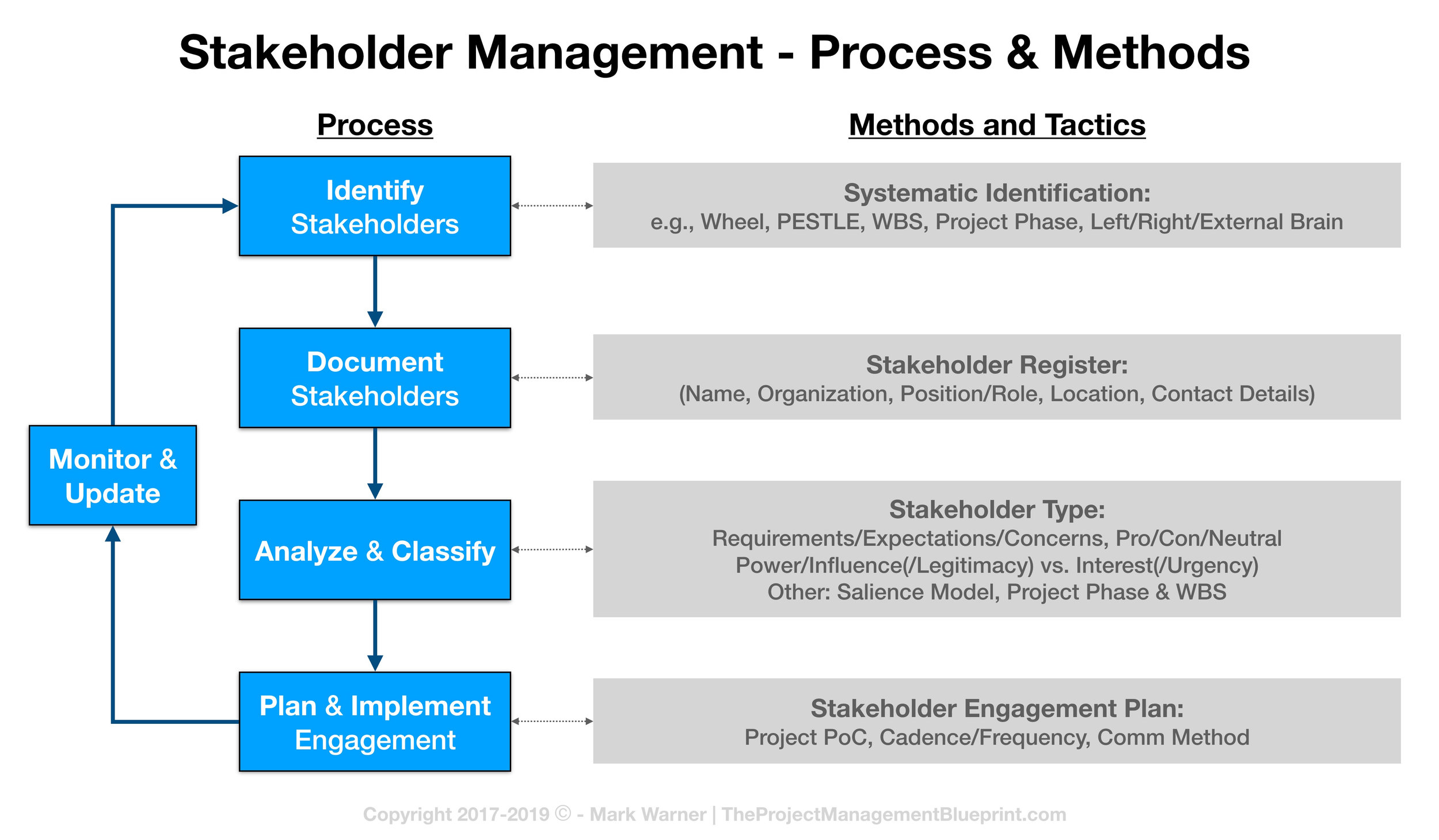

This refers to managing all activities that are involved in a project's execution.

This includes defining the scope, identifying the requirements and preparing the budget. We also organize the project team, schedule the work, monitor progress, evaluate results, and close the project.

What can a manager do to improve his/her management skillset?

Through demonstrating good management skills at every opportunity

Managers need to monitor their subordinates' performance.

You should immediately take action if you see that your subordinate is not performing as well as you would like.

You should be able pinpoint what needs to improve and how to fix it.

Six Sigma is so popular.

Six Sigma is easy to use and can lead to significant improvements. Six Sigma provides a framework to measure improvements and allows companies to focus on the most important things.

Statistics

- 100% of the courses are offered online, and no campus visits are required — a big time-saver for you. (online.uc.edu)

- Your choice in Step 5 may very likely be the same or similar to the alternative you placed at the top of your list at the end of Step 4. (umassd.edu)

- The BLS says that financial services jobs like banking are expected to grow 4% by 2030, about as fast as the national average. (wgu.edu)

- The profession is expected to grow 7% by 2028, a bit faster than the national average. (wgu.edu)

- As of 2020, personal bankers or tellers make an average of $32,620 per year, according to the BLS. (wgu.edu)

External Links

How To

What are the 5S for the workplace?

The first step to making your workplace more efficient is to organize everything properly. A clean desk, a tidy room, and a well-organized workspace help everyone stay productive. The five S’s (Sort. Shine. Sweep. Separate. and Store) all work together to ensure that every inch is utilized efficiently and effectively. These steps will be covered one-by-one and how they can work in any kind of setting.

-

Sort.Put away papers and clutter so that you don't waste valuable time searching for something that you know is there. This means that you should put things where they are most useful. It is a good idea to keep things near where you are most likely to refer to it. It is important to consider whether or not you actually need something. If it does not serve a purpose, get rid of it.

-

Shine.Keep your belongings neat and orderly so that you spend less time cleaning up after yourself. Get rid of anything that could potentially cause damage or harm to others. If you have lots of pens, it is a good idea to find a safe place to keep them. It might mean investing in a pen holder, which is a great investment because you won't lose pens anymore.

-

Sweep. Keep surfaces clean to avoid dirt building up on furniture or other items. You may want to invest in some dusting equipment to ensure that all surfaces are as clean as possible. To keep your workspace tidy, you could even designate a particular area for dusting and cleaning.

-

Separate. Separating your trash into different bins will save you time when you need to dispose of it. To make it easier to throw away your trash without having to look for it, trash cans are often strategically placed throughout an office. Make sure that you take advantage of this location by placing trash bags next to each bin so that you don't have to dig through piles of trash to find what you need.